Accounting management, invoicing, foreign charges, capital deposits, customer support… there are so many criteria to evaluate when choosing a bank adapted to your status, your business and your ambitions.

In this article, we offer you an expert comparison of the 7 best banks for freelancers.

As a micro-entrepreneur, it’s not just good practice: you’re legally obliged to open a dedicated account as soon as your sales exceed €10,000 for two consecutive years. And if you’ve set up a company (SASU, EURL, SARL, etc.), opening a business account is no longer an option, but a legal obligation from the moment you register.

But beyond regulatory requirements, opening a bank account tailored to your freelance activity is a real management lever. A bank designed for freelancers, the self-employed and small businesses offers you much more than just the ability to cash in your income.

Here’s what’s in it for you:

✅ A clear separation between personal and business finances, essential for monitoring the profitability of your business and avoiding confusion during annual audits or balance sheets.

✅ Integrated tools to automate your accounting, categorize your expenses, export your accounting data or even generate invoices in just a few clicks.

✅ Fewer administrative errors, thanks to automatic reminders, well-structured histories and notifications of thresholds or upcoming charges.

✅ A considerable time-saver, because everything is centralized in an intuitive interface, designed for freelancers who want to concentrate on their core business, not on paperwork.

Choosing the right professional bank is not a constraint: it’s an investment in your organization, your peace of mind and your professional credibility. And in 2025, there’s no shortage of online solutions to simplify your life.

Qonto is undoubtedly the most comprehensive solution for freelancers with a legal structure (SASU, EURL) or more advanced needs. You can deposit your capital online, generate virtual cards, invite your accountant and manage your transfers seamlessly.

Designed for professionals, the interface is modern, intuitive and perfectly adapted to the needs of a growing independent business. Qonto allows you to centralize your operations and gain in efficiency on a daily basis.

Features

- Capital deposit online

- Multi-user management

- Physical and virtual map

- Price: from €9/month

Benefits

- Simple, intuitive interface

- Integrated tools for accounting management

- Fast account opening, 100% online

- Capital deposit, collaborative access, accounting

Disadvantages

- No cash deposit possible

- No free offers

Shine, a subsidiary of Société Générale, offers a bank account dedicated to the self-employed, with a simplified interface and practical features: creation of estimates, invoices, URSSAF reminders, legal assistance…

All this is complemented by responsive customer support 7 days a week, which is a real advantage for freelancers who are just starting out or are not very comfortable with the administrative side of things.

Features

- Creation of quotations and invoices

- URSSAF contribution reminders

- French IBAN + Mastercard

- Price: from €3.90/month

Benefits

- Integrated billing tools + human support

- No commitment with flexible packages

- Clear, intuitive user interface

Disadvantages

- Limited cheque cashing

- No cash deposit

Hello bank! Pro combines the power of a major banking group with the flexibility of digital technology, a rare balance for demanding freelancers. You can manage your day-to-day operations from your smartphone (transfers, cash receipts, cash flow) while benefiting, when necessary, from a direct access to a dedicated advisor who understands the challenges of your business: equipment purchasing, international development, or tax optimization.

Unlike limited neobanks, Hello bank! Pro draws on all the expertise of BNP Paribas: solid financing solutions, tailored insurance offers and integration into a network of established entrepreneurs. A reassuring choice for self-employed people aiming for stable growth, without sacrificing their autonomy or day-to-day agility.

Benefits

- A 100% mobile business account with French IBAN

- Deposit of cheques and cash in branch

- Visa Business card included

Disadvantages

- No integrated billing

- Complex account opening

Revolut Business stands out for its international dimension. If you invoice abroad, work in foreign currencies or travel frequently, this solution will enable you to drastically reduce your costs while maintaining precise control over your transactions.

The free offer allows you to get started with no commitment, while the paid versions provide access to advanced functions (sub-accounts, API, accounting integration).

What sets Revolut apart

- Physical and virtual maps

- Foreign fees: 0.4 to 2.5%.

- Rate: From €7/month

Benefits

- Open a multi-currency account online

- Multi-currency, SWIFT and SEPA transfers

- Create physical or virtual cards

- Ideal for international freelancers

Disadvantages

- Frequent price changes

- Limited accounting tools

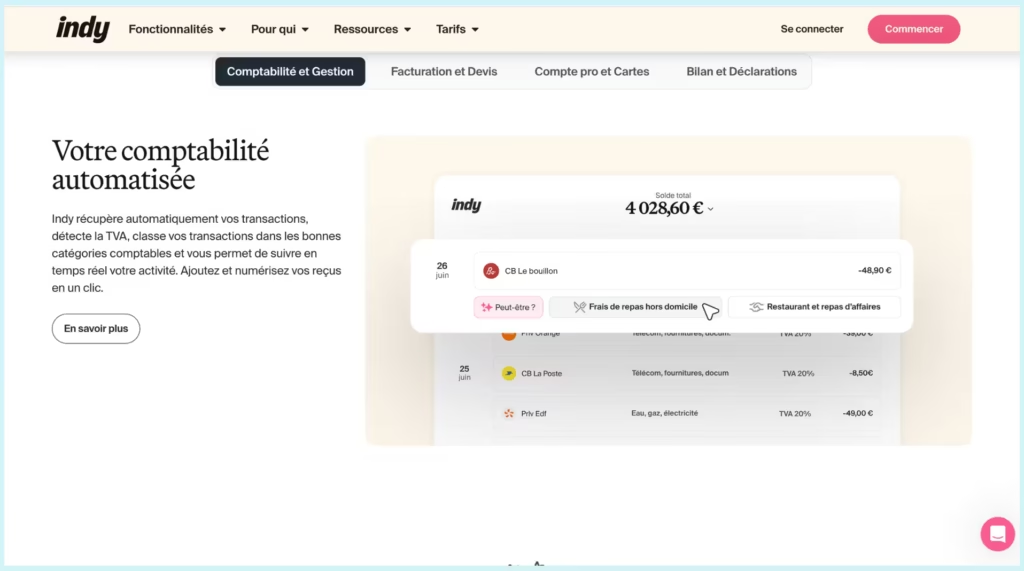

Indy is aimed at freelancers with micro-businesses or BNC (liberal professions). Unlike many neobanks, this solution offers a free bank account, coupled with a genuine automated accounting tool.

You can create invoices, track expenses, categorize transactions and generate tax returns (URSSAF, taxes, VAT) effortlessly.

Features

- Automated load calculation

- IBAN FR + free Mastercard

- Native integration with URSSAF

- Accounting + billing

- Rate: 0 € (no subscription)

Benefits

- Simplified, automated accounting

- A free pro account with fast French IBAN

- Pre-filled returns (URSSAF, VAT, taxes)

- Integrated invoicing with payment tracking

Disadvantages

- Unsuitable for multi-currency use

- No capital deposit

Blank is a French neobank designed for the self-employed who want to save time and avoid unpleasant surprises. Much more than a simple pro account, the application integrates automated invoicing with VAT calculation, immediate separation of your personal and professional finances, and a unique automatic provision system for your social security charges and taxes. You anticipate, you breathe, you stay in control.

Everything is centralized: alerts for unpaid reminders, administrative reminders, adaptation to your status (auto-entrepreneur, self-employed, EURL).

Benefits

- Open a pro account online with French IBAN

- Create quotes and invoices in just a few clicks

- Receive personalized administrative reminders

Disadvantages

- Foreign payment charges

- No free plan

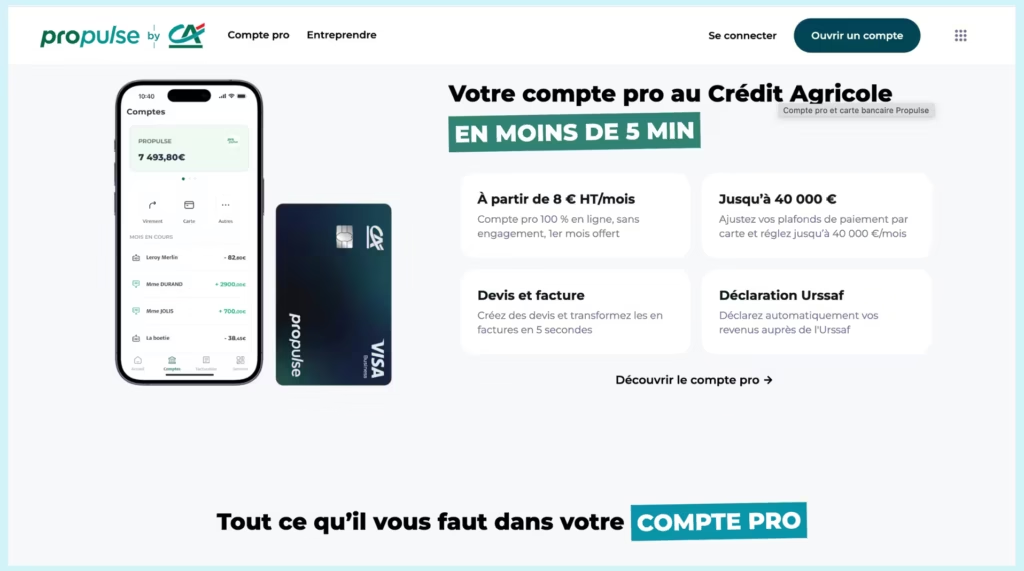

PropulsebyCA isCrédit Agricole’s digital offering for the self-employed and very small businesses. This solution combines an intuitive digital interface with the solidity of France’s leading local banking network.

What’s in it for you? A dashboard that automatically analyzes your cash flow, financing solutions released in 48 hours with no paperwork, and a dedicated advisor who really understands the challenges of your business sector.

Where most neobanks leave you to face the challenges alone, PropulsebyCA offers you a complete ecosystem: integrated billing tools, privileged access to a network of entrepreneurs, and specific expertise (legal, tax, development) accessible at the click of a button or by appointment.

Benefits

- Open your pro account in just a few minutes

- Competitive rates from €8/month, with no hidden charges

- Optimum regulatory compliance

Disadvantages

- Limited functionality for VSEs

- No cheques cashed

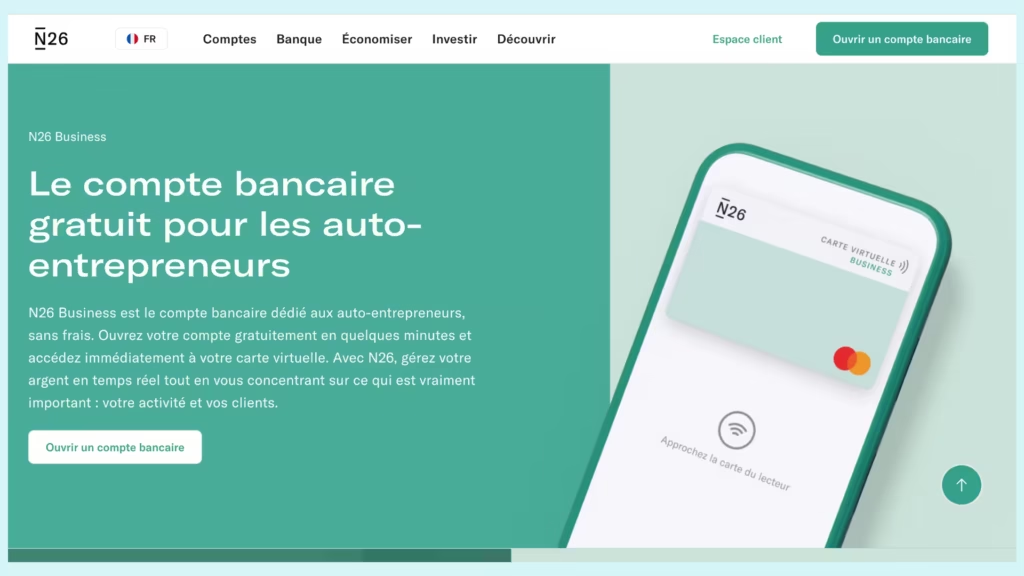

N26 is a 100% mobile bank that frees the self-employed from the red tape of traditional banks. Present in 24 European countries, you can open an account in less than 10 minutes, without needing to make an appointment or travel. You have immediate access to a clear, fluid interface, totally designed to manage your business from your smartphone.

On a day-to-day basis, N26 helps you manage your finances with automatic categorization of expenses, dedicated spaces for your projects, and real-time notifications. When you’re abroad, you benefit from free foreign exchange payments at the real rate, a real plus for mobile professionals. Its transparent pricing and minimalist approach make N26 an ideal solution for freelancers who want to remain agile and focused on the essentials.

Benefits

- Open your pro account in less than 10 minutes

- Pay abroad with no hidden charges

- Ultra-smooth mobile interface

Disadvantages

- Customer service response time

- Limited pro features

Finomis a Swiss Army Knife for the self-employed who want to lighten their day-to-day management without losing control. This European fintech centralizes in a single application the tools essential to your business: a multi-currency pro account designed for international use, an automatic recognition system for expense reports, and integrated invoicing with notifications as soon as a payment is received.

Also designed for teamwork, Finom offers advanced multi-user management, with personalized access according to role. By automatically connecting your transactions to your accounting software, you can reduce the time spent on administrative tasks by up to 80%, so you can focus on what really matters: developing your business.

Features

- Up to 3% cashback

- Creation of quotations and invoices

- IBAN FR + Mastercard

- Synchro compta QuickBooks...

- Price: free offer

Benefits

- Open a free pro account in just a few minutes

- Generate invoices directly from the application

- Get up to 3% cashback on your purchases

- Connect your accounting tools and save time

- Manage your business in multiple currencies

Disadvantages

- No capital deposit

- Limited free plan

Monabanq is a French online bank offering accessible, transparent services with no income requirements. It is aimed at individuals, self-employed entrepreneurs and very small businesses looking for a simple, reliable banking solution. Accounts are opened entirely online, with human support at every stage.

Designed for those who want to manage their money independently, Monabanq offers a full range of services: bank card, transfers, checkbook, intuitive interface and customer support based in France. It’s a solid alternative for the self-employed who want professional, flexible banking with no hidden costs.

Features

- Cash and cheque deposit

- Choice of Visa cards

- Integrated RC Pro

- Price: from €9/month

Benefits

- Deposit of cheques and cash in branch

- Visa Premier card included

- Quick account opening

Disadvantages

- Reserved for auto-entrepreneurs)

- No billing tools

Conclusion

As a freelancer, your bank should be a lever for simplification, not a constraint. Some solutions will save you time on your declarations, others will enable you to better manage your quotes or optimize your international expenses.

The key is to choose the one that best suits your business, your preferences and your management volume. Fortunately, all the banks presented here can be opened online, often in just a few minutes.

FAQ

Indy (for accounting) and Blank (for administrative management) are the most comprehensive.

Indy is 100% free. Finom also offers a free cashback plan.

Yes, it's possible with Qonto, Shine, Blank or Hello bank! Pro .

Shine, Blank, Indy and Finom include a billing module.

All you need to do is provide proof of identity, proof of address and a document certifying your activity. Opening is 100% online.