By 2025 professional online banks have established themselves as essential partners, thanks to their simplicity, tailored services and 100% digital accessibility. However, with so many products on offer, it’s not always easy to find the right one for your specific needs.

This article guides you through the 8 best online business banks this year, analyzing their strengths, fees and the tools they offer to support you on a daily basis. The aim: to help you make an informed choice, quickly and adapted to your entrepreneurial profile.

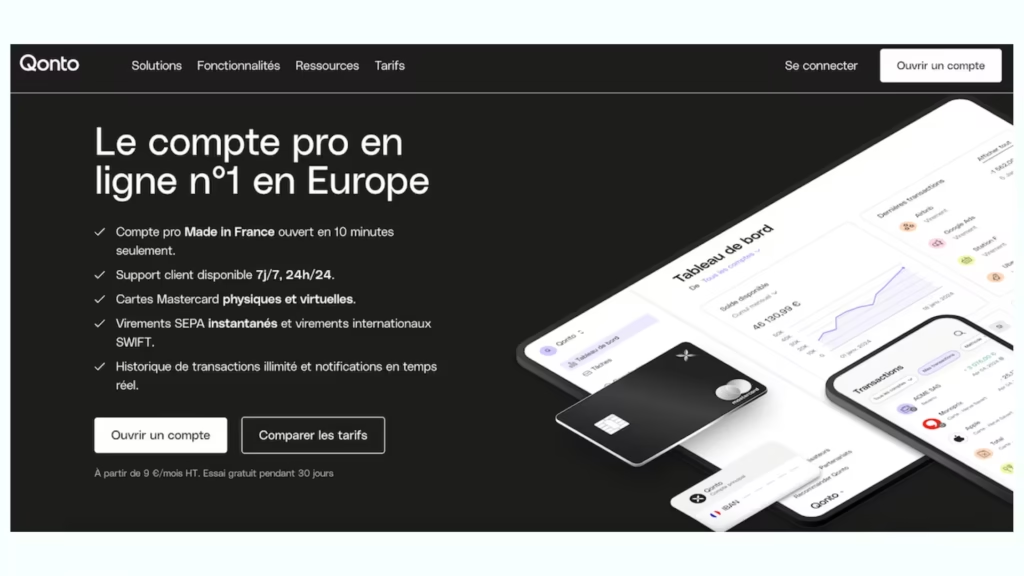

Qonto is a 100% online banking solution designed for the self-employed, start-ups, VSEs and SMEs. It’s easy to set up (less than 10 minutes), with a fluid interface and an instant French IBAN. Everything is designed to save time: configurable pro cards, multi-user management and accounting synchronization.

Beyond the account, Qonto offers a genuine financial management tool. Track cash flow, automate expense reports, categorize expenses, collaborate with your accountant… the platform centralizes everything in a clear dashboard.

Ideal for those who want to stay in control, without getting bogged down in administration.

Avoid if you need cash deposits or a physical banking relationship.

VSE - SME - Freelance

- Capital deposit possible

- Multi-accounts

- Physical & virtual maps

- VAT declaration

- Subscription €9

Benefits

- Ease of use

- Easy account creation

- Suitable for all company sizes

Disadvantages

- Fewer options for pro loans

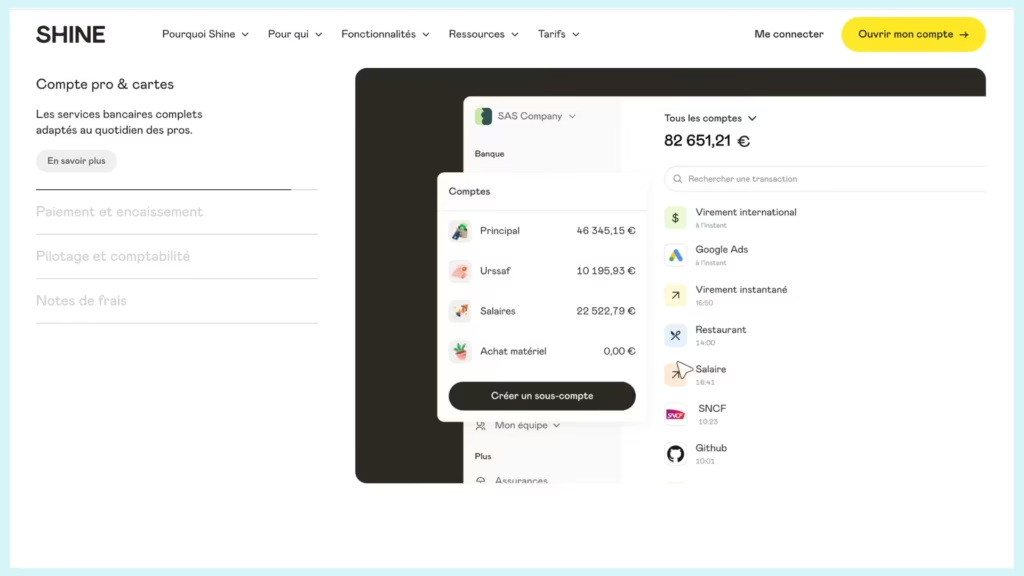

Shine is a neobank designed to simplify the lives of self-employed entrepreneurs, freelancers and managers of small businesses. Fast account opening, intuitive interface, French IBAN, Mastercard pro… everything is designed to make banking smooth and accessible, without jargon or complexity.

But Shine goes further than a simple pro account. The tool offers real administrative support: tax reminders, estimated charges, invoice generation, VAT tracking… It’s an ideal solution for self-employed people who want to manage everything from a single space, without having to multiply the tools.

On the other hand, it is less suited to more structured or fast-growing companies.

Ideal for freelancers

- Starting a business

- Capital deposit possible

- Pro account & cards

- From €7.90 / month

Benefits

- Intuitive interface

- Responsive customer service

- Tax management tools

Disadvantages

- Limited for large companies

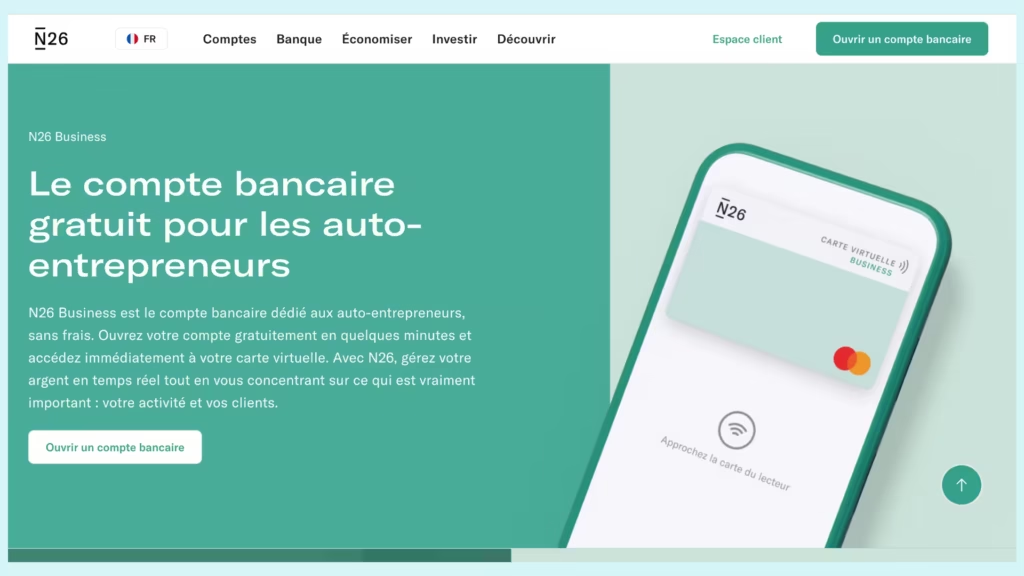

N26 Business offers an innovative digital banking solution specially designed for entrepreneurs and freelancers. This offering from German neobank N26 stands out for its intuitive use and fast account opening procedure.

N26 Business stands out for its flexibility and accessibility. Account management via the mobile app allows professionals to control their finances anywhere, anytime – ideal for traveling entrepreneurs or those managing multiple projects.

N26 Business offers various subscriptions: N26 Business, N26 Business Smart, N26 Business You, and N26 Business Metal, offering various services such as free international withdrawals, additional insurance, and cashback on purchases.

For freelancers

- Integrations (PayPal, Wise)

- Physical bank cards

- Rate - €4.90/month

Benefits

- Intuitive interface

- Multi-currency bank account

- Zero fees for foreign payments

Disadvantages

- Restrictions on free withdrawals

Hello bank! Pro is aimed at self-employed entrepreneurs who want an efficient online bank, while retaining access to traditional services. Thanks to the BNP Paribas network, it enables cheques and cash to be cashed at the branch– a rare advantage among neobanks.

The application is fluid, the Visa card included, and the offer remains simple at €10.90/month. It’s a good option if you need digital flexibility, without giving up certain physical services.

On the other hand, it is not available to companies (SASU, SARL…), which can quickly become a limiting factor when changing status.

Freelancers - SMEs

- Virtual map available

- Multi-account management

- Subscription € 11.50/ Month

Benefits

- Cheque and cash deposits

- Intuitive mobile application

- Dedicated customer service

Disadvantages

- Limited advanced features

- Foreign withdrawals subject to a fee

Revolut Business is ideal for freelancers and companies working abroad or managing multiple currencies. It allows you to manage over 25 currencies, with fast international transfers and no hidden fees, all via a fluid, intuitive interface.

The platform offers local IBANs, physical and virtual cards, and tools to manage teams and automate payments. It’s a powerful solution for digital professionals and international startups. Less suitable, however, if you need a French IBAN or traditional banking services.

Ideal for freelancers

- Physical & virtual map

- Multi-currency account

- Multi-user accounts

- Price €9

Benefits

- Intuitive interface

- Competitive rates

- Free international payments

Disadvantages

- Premium features for a fee

- Fees on certain transactions

Finom is a banking and accounting solution designed for the self-employed, freelancers and very small businesses. Account opening is fast, 100% online, with a French or German IBAN depending on your country. The platform lets you manage multiple accounts, track expenses in real time, centralize invoicing and automate accounting. Everything is designed to simplify financial management for small businesses, without complexity or jargon.

One of its real assets: cashback of up to 3% on certain expenses, a free account available, and unlimited SEPA transfers depending on the offer chosen. Finom also offers unlimited virtual cards, free ATM withdrawals (up to €2,000/month), and multi-user access.

An agile, efficient solution, ideal for digital professionals, consultants or small teams who want to manage everything from a single tool.

Benefits

- Easy to use

- Cashback on paid plans

- Suitable for all company sizes

Disadvantages

- Advanced features for a fee

- Limited classic functionality

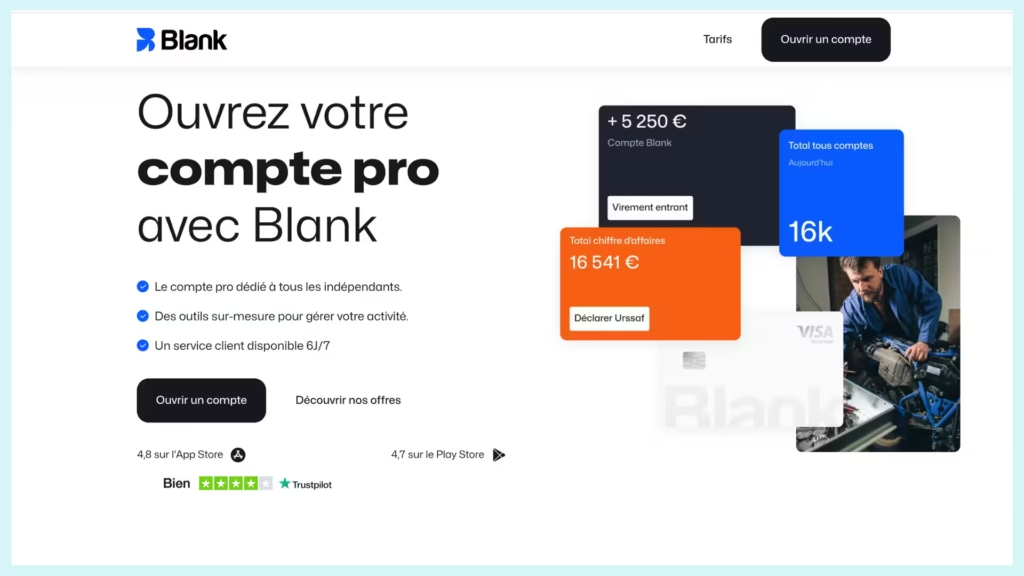

Blank is a neobank designed to meet the practical needs of auto-entrepreneurs, freelancers and small businesses. More than a simple pro account, it offers a suite of integrated tools to save time on administrative tasks: creation of estimates and invoices, estimation of contributions, automated URSSAF declarations, scanning of receipts, and seamless accounting export. Everything is centralized in an intuitive, mobile and 100% online interface.

Blank’s strength lies in its ability to automate time-consuming tasks and provide real-time management of your business. Thanks to dashboards and tracking tools, you can keep a clear overview of your finances.

It’s a solution for professionals who want to stay focused on their core business, without sacrificing accounting rigor.

For the self-employed

- URSSAF declarations

- Multi-currency payments

- 6 excl. tax/per month

Benefits

- Competitive rates

- Intuitive mobile interface

- Responsive customer support

Disadvantages

- Advanced features for a fee

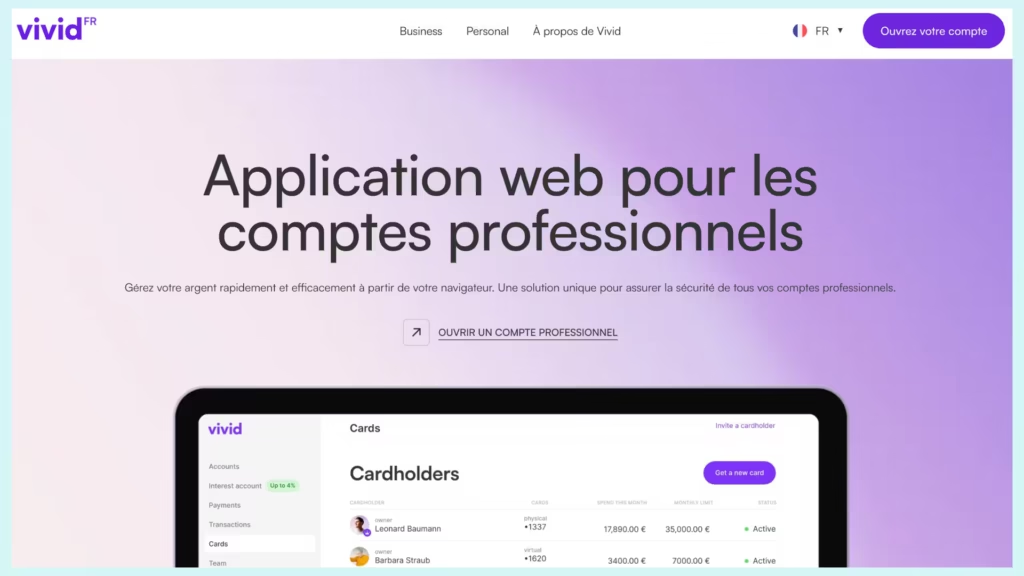

Vivid offers a hybrid pro account designed for freelancers and entrepreneurs who work online or internationally. European IBAN (DE, ES or IT), unlimited sub-accounts, metal or virtual card: everything is simple, fast and well designed to segment your financial flows.

Where Vivid stands out is in its native investment integration. From a single app, you manage your spending and can invest in the stock market or crypto. Add to that interest of up to 4% on your balances, and it becomes a real alternative to traditional banks – provided you don’t need aFrench IBAN, check deposit or integrated accounting.

Benefits

- Intuitive mobile application

- Free bank card

- Equity and crypto investments

Disadvantages

- Not suitable for companies

- Trader compatibility problems

Conclusion

Choosing the right professional online bank depends above all on your legal status, the nature of your business and your day-to-day needs. The self-employed, freelancers and auto-entrepreneurs will find what they’re looking for with solutions such as Shine, Blank or Finom, which combine simplicity, essential banking services and tools to automate administrative management. For those looking for a more robust and scalable offering, Qonto remains a benchmark, particularly for VSEs and startups in the process of structuring.

On the other hand, if you work internationally or in a 100% digital environment, options such as Revolut Business or Vivid can be very powerful, provided you do without certain French functions such as IBAN FR or cheque cashing. The key is to choose a solution that adapts to your needs, saves you time and lets you keep control of your finances, without unnecessary complexity.

FAQ

For auto-entrepreneurs, Shine, Blank and Qonto are among the best options in 2025. Shine stands out for its intuitive interface and administrative support, while Blank is appreciated for its tools designed for the self-employed. Qonto, a little more expensive, is ideal if you're planning to become a company (SASU, SAS...).

Yes, Finom (free Solo offer) and N26 Business offer free business accounts. Beware, however: these packages are limited in terms of functionality (non-French IBAN for N26, no check deposit, limited support, etc.).

Some banks, such as Shine, Blank or Qonto, offer support in setting up a business, and allow you to open an account at the same time as you file your articles of association (particularly for SASU, SAS, EURL).

Yes, several neobanks such as Qonto, Shine, Blank or Hello Bank Pro allow you to deposit cheques. The procedure varies according to the bank (postal service, mobile application). Some may charge for this service.

Yes, but beware of conditions:

-

Qonto, Finom and Anytime are adapted to European activities.

-

If you invoice internationally, check that theIBAN is French (FR) to avoid refusals.

-

N26 uses a German IBAN (DE), which can cause problems with certain French organizations (URSSAF, Trésor Public, etc.).